Paying employees is only part of doing payroll. You also have to make sure that everything is correct, legal, and efficient, and that you don’t make mistakes that cost a lot of money. Still, payroll management is still a difficult and error-prone job for many firms. Doing payroll by hand can cause extra stress and financial consequences, from figuring out taxes to managing benefits.

The good news?

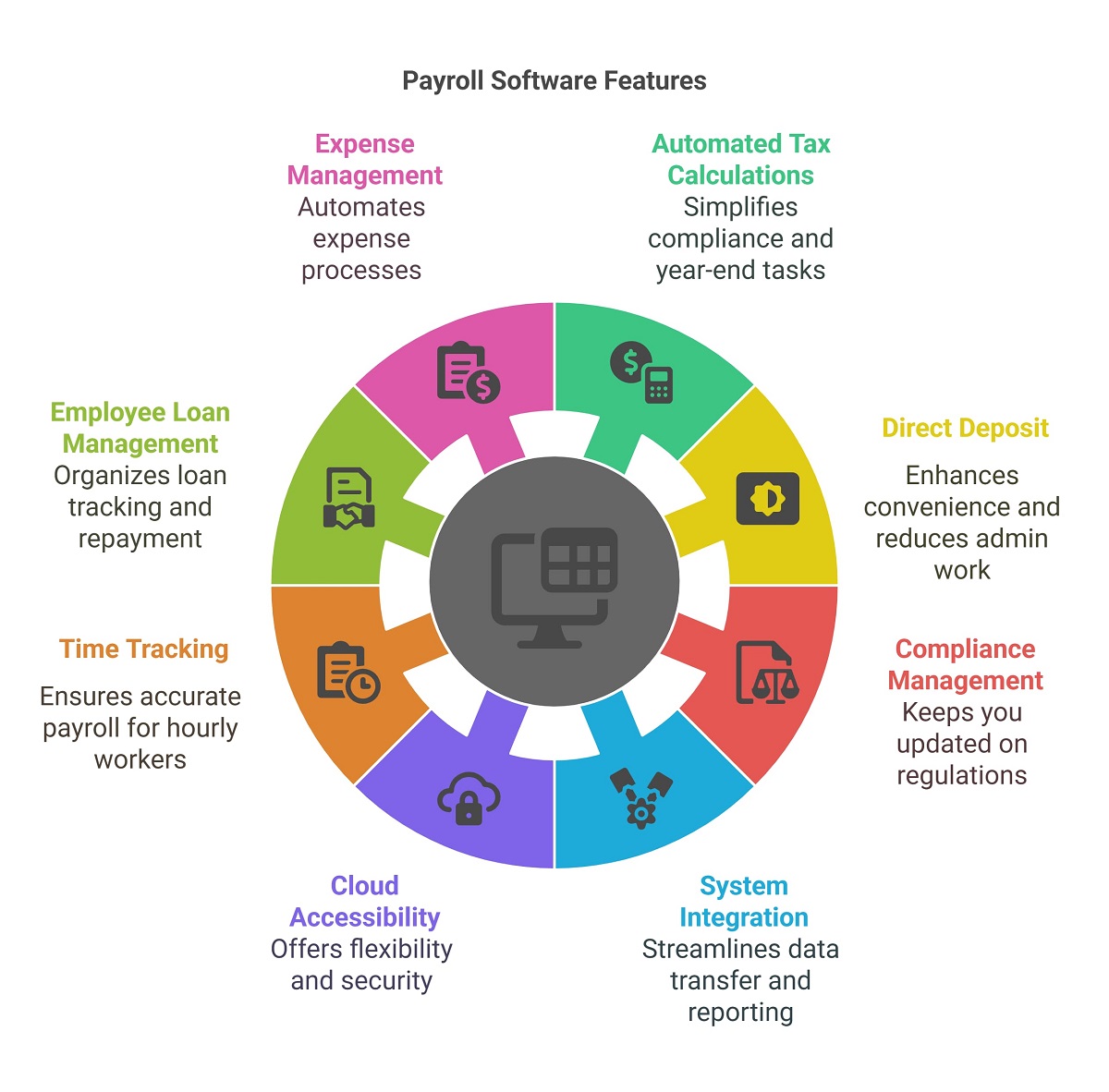

Modern payroll software can automate and simplify these important tasks, which saves time, makes sure everything is correct, and keeps firms in accordance with the law. We’ll go over the most important payroll elements in this article that can turn payroll from a pain into a smooth, stress-free process. Knowing these things can help you pick the finest payroll software for your needs, whether you own a small business or work in HR.

The Best Payroll Software: Top Features to Look For

1. Figuring out how much to pay employees

One of the best things about payroll software is that it can figure out how much to pay each employee. This ensures that payroll is done correctly by automatically figuring up gross wages, overtime, bonuses, and deductions. This function is very important for businesses since it stops people from making mistakes, makes sure employees are paid accurately and on time, and helps them follow labor rules.

Use Cases

- Figuring out how much part-time workers make per hour

- Handling payments based on salary with incentives

- Calculating overtime automatically

- Following the rules about work

2. Withholding taxes and deductions automatically

Automated tax and deduction withholding ensures that businesses correctly figure out and withhold federal, state, and local taxes, as well as other deductions including benefits and garnishments. Businesses can reduce compliance risks, prevent fines, and make sure that employees’ withholdings are handled correctly without having to do it themselves by automating this procedure.

3. Processing of Direct Deposits

Businesses can electronically send employee wages directly to their bank accounts using direct deposit processing. This feature does away with the need for paper checks, speeds up payments, and makes them safer. It also makes sure that employees get their pay on time and cuts down on administrative costs.

Examples of Use:

- Paying employees on time without having to hand out checks by hand

- Allowing each employee to make contributions into more than one bank account

- Tools for checking bank accounts

- Encryption that keeps transactions safe

- The ability to change the timing of direct deposits

4. Paychecks for workers that are printed

Payroll software makes it easy for firms to make and print checks rapidly for employees who want paper checks. This option makes sure that all employees, including those who don’t have direct deposit, get their payments on time, which keeps them happy and trusting in payroll operations.

Some examples of use cases are:

- Giving wages to workers who don’t have bank accounts

- Check templates that can be changed

- Working with hardware that prints checks

5. Making payroll tax forms

Payroll tax form generating makes it easier to make important tax forms like W-2s and 1099s for employees and contractors. This feature makes year-end tax reporting easier, saves time, and makes sure everything is correct, which lowers the chance of mistakes and any tax compliance problems.

Examples of Use:

- Making W-2s for workers

- Making 1099 forms for freelancers

- Sending tax forms electronically to the IRS: Things to think about:

- The ability to file electronically

- Following IRS rules

- Safe preservation of data

6. Integrations for Payroll Vendors

Seamless payroll vendor interfaces link payroll software to applications for accounting, human resources, and tracking time. This feature cuts down on redundant data entry, improves reporting, and makes sure that all business procedures are accurate, which makes managing the workforce easier overall.

Examples of Use:

- Getting payroll information to work with accounting software like QuickBooks

- Adding tools to HR and payroll software to keep track of employee perks

- Linking up with time-tracking systems such as Controlio to make sure payroll is correct

- Works with the business software you already have

- Access to the API for bespoke integrations

- Syncing data in the cloud

7. Payments on Demand and Off-Cycle

Businesses can make payments outside of the normal payroll schedule via off-cycle and on-demand payments. This function is useful for handling bonuses, early wage access, or termination compensation. It gives both companies and employees more financial freedom while still making sure that payroll is done correctly.

When to Use:

- Giving out performance bonuses

- Paying fired staff right away

- Giving employees early access to their pay as a benefit

- Following the rules about wages

- Support for several ways to pay